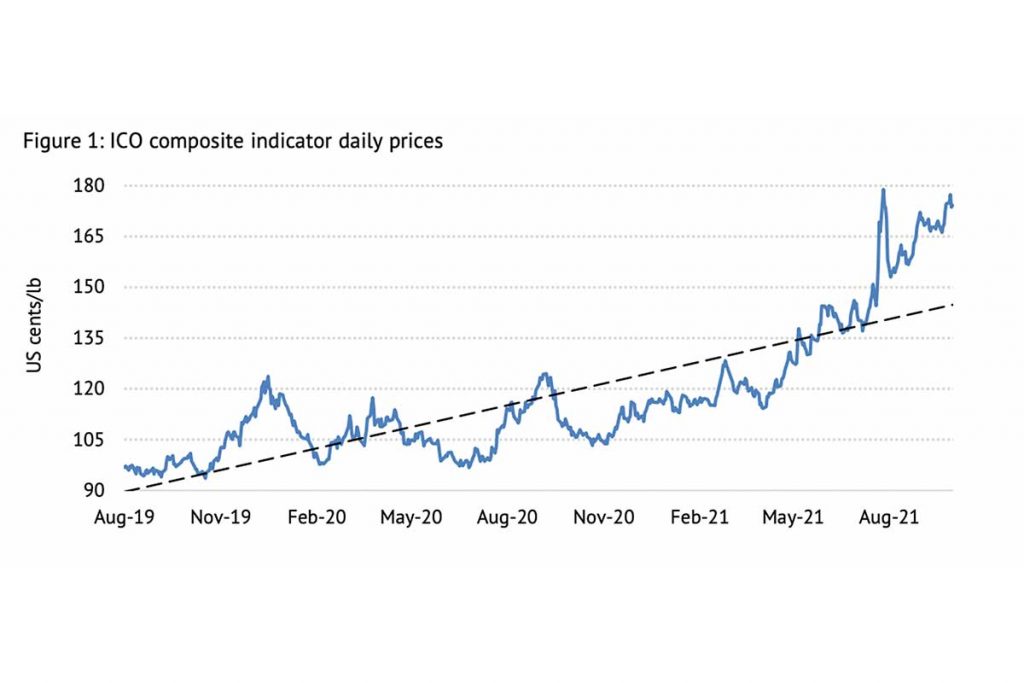

In September 2021, the International Coffee Organization (ICO) composite indicator of coffee prices rose by 6.2 per cent to 170.02 US cents per pound, as compared to 160.14 US cents per pound in August 2021.

This marks the highest average price recorded since February 2012 and represents a 60.6 per cent increased as compared to the 105.85 US per pound recorded at the beginning of the coffee year in October 2020.

The ICO says that this steady upward trend seen since the beginning of the 2020/21 coffee year confirms the recovery of coffee prices after three consecutive years of low-price levels.

Prices for all group indicators increased in September 2021 and reached their highest levels in several years.

The highest increase was seen in the Robusta Group’s indicator price, which reached 104.6 US cents per pound, which marked an increase of 9.9 per cent, as compared to 95.18 US cents per pound in August 2021. This is the first time since August 2017 that Robusta prices have breached the 100 US cents per pound ceiling.

The price for the Colombian Milds increased by 6.6 per cent to 240.38 US cents per pound in September 2021 as compared to 225.40 US cents per pound in August 2021. This price level reached by the Colombian Milds in September 2021 is also the highest monthly average recorded since 244.14 US cents per pound was recorded in February 2012.

It also represents a rise of 55.8 per cent from 154.28 cents per pound recorded in October 2020.

Prices for the Other Milds increased by 4.3 per cent to 225.54 US cents per pound in September 2021, as compared to 216.24 US cents per pound in August 2021. This is the highest monthly average since 237.21 US cents per pound was registered in January 2012.

Compared to its level of 152.06 US cents per pound n October 2020, the Other Milds indicator increased by 48.3 per cent.

The monthly average price of the Brazilian Naturals reached 183.72 US cents per pound in September 2021, reflecting a five per cent increase as compared to 174.89 US cents per pound in August 2021.

This marks an 83 per cent increase from October 2020 and is the highest since 197.05 US cents per pound was recorded in October 2014.

Although coffee prices continued to rise, the ICO says it was weakened by its volatility across September 2021. Intra-day volatility of the ICO composite indicator price fell by 8.6 per cent to 8.2 per cent in September 2021.

The Brazilian Naturals indicator showed volatility of 10.5 per cent, the Colombian Milds and Other Milds recorded the same level of volatility at 9.1 per cent and Robusta prices had the lowest volatility at 7.5 per cent in September 2021.

Estimates for total production for the 2020/21 coffee year remain unchanged at 169.6 million 60-kilogram bags, marking a 0.4 per cent increase as compared to the predicted 169.0 million 60-kilogram bags in 2020.

World coffee consumption is resuming its steady growth of the last 10 years, to pre-pandemic levels. It is projected to rise by 1.9 per cent to 167.26 million bags in 2020/21, as compared to 164.13 million bags that was predicted in the 2019/20 coffee year.

Exports of all forms of coffee in August 2021 totalled 10.12 million bags, which was down compared to the 10.13 million bags recorded in August 2020.

The ICO says the coffee market continues to be driven by the weather in Brazil and COVID-related disruptions that have affected trade in Asia.

To read the report, click here.