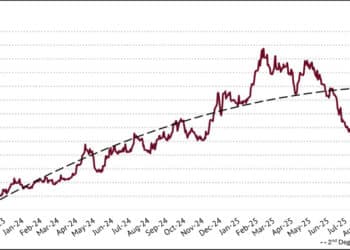

Brazil’s current coffee crop is not looking good. While some players in the market dispute just how bad the situation is, a more severe deficit than previously anticipated is brewing for buyers and consumers ahead of the key roaster season, which began in the last quarter of the year.

Since the new crop started to reach mills and exporters in earnest as of late July, mounting evidence has emerged that confirms not only a significant drop in the overall crop, but also a sharply reduced average bean size.

“Look at this, it’s terrible, it’s the smallest beans we have ever harvested here,” says Moacir Aga Neto of the Cerrado Coffee Growers Federation, showing a sample of new crop during a visit to Cerrado by GCR Magazine in late July.

With a disturbingly large share of black and hollow beans, the sample is a sad sight for coffee lovers, with most of the beans in the sample not much bigger than a peppercorn.

Based in the Minas Gerais coffee region, the Cerrado harvest is running six weeks late as the drought last year delayed the main flowering until the very end of October, and that was before the dry spell in January, which reduced the bean size.

Producers across the region are expecting the final harvest result to be between 20 and 30 per cent below last year and the final volume from the region may not even surpass 4.5 million 60-kilogram bags, says Aga Neto. This compares to the region’s average harvest in a season with regular weather of at least 6 million bags.

Travelling through the Brazilian coffee belt from Cerrado down to the Southern Minas coffee town of Guaxupe, the outlook doesn’t improve much.

Home to the Cooxupe cooperative with more than 11,000 producer members, Cooxupe is by far the biggest coffee cooperative in the world, handling between 5 million and 6 million bags in an average crop cycle –a volume that equals that of Costa Rica, El Salvador and Guatemala combined.

“It’s still too early to make a final evaluation, but the harvest is delayed and there is no doubt that the drought has had an impact,” says Carlos Paulino da Costa, President of the Cooxupe cooperative.

Figures from Cooxupe show the total harvest in the regions of Cerrado, Southern Minas and Sao Paulo state was 42 per cent complete by 25 July, while in previous years at this date the harvest was between 51 and 65 per cent completed.

The harvest delay is significant, as the late maturation of cherries always causes logistical headaches to producers. To make matters worse, this year the delay of picking was followed by the onset of unseasonal rains in late June.

“I was so relieved that I had managed to make it through the delay to the flowering, through the dry spell in January and still managed to produce a decent harvest,” says Valter Lima de Melo Junior, a small grower with 20 hectares in the Cooxupe region. “Then on 30 June it started raining and for the next 10 days it remained rainy or overcast.

“The rains came just after I had finished harvesting and had all my coffee drying on patios, and as a result most of the coffee got fermented. Now I have to sell almost all of it at a heavy discount,” adds Lima de Melo.

The latest troubles in Brazil all began three crops ago with the drought in Espirito Santo in the first quarter of 2013 that led to a drop of some 5 million 60-kilogram bags from that state alone in Brazil’s 2013-14 harvest. With average annual production of between 15 and 16 million bags, Espirito Santo is Brazil’s second largest coffee growing state.

If weather had been kind to Espirito Santo this year, the 2015-16 cycle could have been the year – as the third crop after a severe drought – where plants and soils would have been able to stage a recovery.

Instead, between the start of flowering in Espirito Santo last September and through February, when the young coffee cherries go through the crucial period of bean formation, the state recorded over 100 days without any rains, according to Conab, Brazil’s official agency in charge of crop estimates for the Agriculture Ministry.

Conab has pegged the 2015-16 harvest to yield 44.25 million bags. Although Brazil crop figures always come in a wide range – from as low as 40 million bags from the most pessimistic growers associations to as high as 51 million bags according to the most optimistic traders – consensus is building around the new crop to yield about the same as the 2014-15 harvest, which according to Conab ended at 45.34 million bags.

The impact of the delay to the current harvest, as well as unseasonal rains in late June, should not be underestimated, says Carlos Brando of coffee consultancy P&A International Marketing.

“The impact of rainy and overcast weather at this stage of production is primarily on the quality of coffee harvested under these conditions and the inability to pre-dry or fully dry coffee is perhaps the worst quality impact of adverse weather that coffee can suffer during the harvesting season.

Delays in harvesting cause cherries to ripen beyond the ideal time to be pulped and expose cherries to the risk of dropping to the ground when they dry on the tree, if not from wind and heavy rains,” says Brando.

Driving through Minas Gerais – which as a single state accounts for up to 60 per cent of the entire national output from Brazil – onward to the state of Sao Paulo, coffee farms cover the landscape for hundreds of kilometres. But considering the stress to the crop from three consecutive crop years of severe drought, trees are looking surprisingly green and healthy.

This is where it gets interesting, especially when visiting bigger farms such as the O’Coffee Brazilian Estates, which is based just outside the town of Pedregulho in Sao Paulo State.

Sao Paulo is on par with the majority of growing regions in Brazil, recording a sharply reduced bean size and the average outlook for the state is for production to drop 20 percent below the forecast. However, the harvest from O’Coffee’s 1000 hectares of coffee is ending flat year-on-year at around 32,000 bags.

“When I started here, production was less than half of what it is today. Since then we implemented a precision agriculture project for which we take 1000 soil samples from all the six farms in the estate and use the highest available technology like GPS coordinates with a tractor sensing application to avoid any waste in our operation,” says Bressani.

From application down to perfection of crop inputs such as fertiliser to selective irrigation, the entire production at O’Coffee has been turned around to a state-of-the-art agricultural operation where even the worst effects of the drought this year have been mitigated through the use of drip irrigation.

“We give each plot of the farm the exact amount of inputs and water it needs and with this system we have increased productivity to 30,000 bags from 15-20,000 bags, and with less input,” he says.

With 20 different “flavour development plots”, O’Coffee has also embarked on a new path for the ultimate coffee lovers in the market, offering everything from both yellow and red Arabica varieties, natural and pulped naturals, semi and fully washed beans.

Back in the Sao Paulo coffee town of Espirito Santo do Pinhal, Carlos Brando says it’s these kinds of inventions that help Brazilian growers maintain their lead in efficient quality production in the world of coffee.

“We know that if you have a well-nourished tree that is well maintained, and when you have the technology and

level of technical investment that we have in Brazil, that can soften a lot of the impact that come from adverse weather,” Brando says. “Many of the kind of quality impacts that are likely to result from delays in harvesting, processing and drying, can often be minimised with modern technology.”

But even as more growers in Brazil are moving towards the level of technical investment seen at estates such as O’Coffee, there is little doubt that the new harvest will leave Brazil with a new deficit.

With an established export demand of at least 30 million bags and local consumption of about 21 million bags, analysts base their world supply-demand balance forecasts on the need for a minimum harvest of 50 million bags from Brazil.

The 2015-16 crop is expected to fall short by at least 5 or 6 million bags, and as the second small crop in a row, most of the existing stocks

Brazil’s coffee industry recorded a “stock disappearance” of at least 9 million bags in the 2014-15 crop cycle, which in Brazil ended on 30 June, according to independent Brazilian analyst Marco Antonio Jacob.

He adds that the total carryover stocks available now may be as low as between 4 and 5 million bags, which would leave the world’s supply-demand balance in a precarious state as world consumption is approaching at least 154 million bags by the end of 2015. “Any final number above 42 million bags is at this point highly optimistic,” he says. GCR