COVID-19 is only the latest blow to the expansion of global value chains (GVCs) also affecting the coffee sector. The World Bank has highlighted that, following two decades of increasing fragmentation of production across countries and regions, GVC growth has stagnated since 2008.

Public sentiment in many advanced economies has become critical of globalisation. Workers feel left behind, companies face increased competition from abroad, and consumers worry about the environmental and social cost of international supply chains. Hence, before the pandemic disrupted logistics networks and rattled international trade, some governments had already reverted to protectionist rhetoric and policies. Disputes between major trading partners, such as the Sino-American trade war on the one hand, and a rise in distortionary policies on the other hand, have put the international trade system under stress.

Could protectionism and policy uncertainty also affect the coffee sector? In July this year, the United States threatened to impose a 100 per cent retaliatory tariff on coffee imports from the European Union (EU). Resulting trade barriers would be the fallout of a long-simmering dispute about subsidies in the aerospace industry. Similarly, in 2018, Canada implemented tariffs on processed coffee imported from the US as a direct response to protectionist measures taken by the US in support of their domestic steel and aluminium industry. These and other high-profile cases suggest that the coffee sector could get caught up in a swing towards protectionist policies.

While the sabre rattling makes news headlines, in this article we investigate if there is concrete evidence that over the past decade, a roll-back of the liberalisation agenda of the 1990s and 2000s, has occurred.

International Coffee Organization (ICO) statistics show that, since the liberalisation of the coffee market at the end of the 1980s, the sector has steadily expanded. Since then, global demand increased by more than 60 per cent to almost 168 million 60-kilogram bags in 2018/19. Over the same period, shipments of roasted coffee have doubled while volumes of soluble coffee increased five-fold. Despite the high growth rates, more than 90 per cent of coffee is still exported in green form. This is likely due to remaining import tariffs on processed coffee and other factors that hold back value addition at origin, and upgrading in global coffee value chains.

We explore this further by looking at the evolution of state interventions affecting international trade of coffee over the past decade. This complements a new ICO report, available online, that details current tariff- and non-tariff trade barriers, published in June during the 126th Session of the International Coffee Council. The data for this exercise is obtained from Global Trade Alert (GTA), a platform that was launched in 2009 in response to the financial crisis and the expectation of the widespread adoption of trade-distorting policies. The platform evaluates interventions by their expected impact that can be either ‘harmful’ or ‘liberalising’.

Harmful interventions will almost certainly discriminate against foreign commercial interests by favouring domestic businesses. These interventions broadly fall into two categories: trade barriers, such as import tariffs, and other trade-distorting measures, such as production subsidies, state loans and trade finance. Liberalising interventions, on the other hand, promote trade on a non-discriminatory basis, for example by dismantling of harmful policies, such as tariffs and other trade-distorting measures.

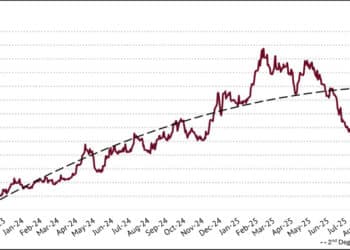

Our quantitative analysis at the ICO compares the number of interventions implemented by exporting and importing countries that are related to the coffee sector. We focus on the 43 ICO exporting Member countries, and the 30 largest importing countries (including all ICO Members) that represent more than 95 per cent of global coffee exports and imports, respectively. For this sample, between January 2009 and July 2020, GTA recorded 153 interventions that have benefitted or harmed partners in the international trade of coffee. As interventions are reported with a time-lag, figures for 2019 and 2020 likely understate the true number of policies that were implemented in those years.

Of all harmful interventions, 60 per cent were implemented by exporting countries, whereas importing countries accounted for 40 per cent. Liberalising interventions were roughly balanced between exporting countries at 52 per cent, and importing countries at 48 per cent. A visual analysis of the data plotted in figure a) cannot confirm a clear trend towards more discriminatory interventions. However, figure b) suggests there is also no significant negative time trend in interventions that benefitted other countries.

Looking at individual countries in the sample, we find that larger exporters and importers are mainly responsible for implementing policies that affect trade (see figure c). Brazil, the largest coffee-producing country, accounts for 32 interventions (23 harmful, nine liberalising). This is equivalent to more than one-fifth of all interventions recorded between 2009 and 2020.

The Russian Federation, the fourth largest importer of coffee, is ranked second with 14 interventions, eight of which were harmful, and six liberalising. The EU recorded seven interventions (five harmful, two liberalising). However, it should be noted that some EU member states, such as Belgium, Denmark, France, Germany, Latvia and the United Kingdom, individually introduced additional interventions that the GTA deems harmful.

This analysis provides preliminary evidence that, despite protectionist rhetoric, trade barriers have not been increasing in terms of the number of interventions implemented annually. Additional research is required, however, to understand the impact of individual interventions on the coffee sector, which would depend on the nature of the interventions, the products affected, and the market size of the implementing country.

Looking ahead, it is encouraging that various recently negotiated free trade agreements could provide a major push for further liberalisation of the global trade in coffee, benefitting producers and consumers across exporting and importing countries. If ratified, deals reached between the EU and the Mercosur bloc, which includes Brazil, as well as more recently between the EU and Vietnam, could address tariff escalation. This would remove obstacles to the upgrade of coffee sectors in some producing countries. Similarly, the African Continental Free Trade Area is expected to boost regional trade through closer integration of the continent.

Tapping into export markets would result in value addition and job creation in the coffee sectors of producing countries. Hence, promoting the deepening of trade cooperation should be an important pillar for the COVID-19 recovery of the global coffee sector.

About us

This article was co-authored by Dr Christoph Saenger and Carmen Steinmetz. Saenger is the Senior Economist at the ICO, conducting research on coffee value chains in Africa, Asia, and Latin America. Prior to joining the ICO, he was an economist at the European Bank for Reconstruction and Development. Steinmetz is a graduate student in development economics at the University of Goettingen, Germany. She is currently an economic research assistant at the ICO.

The ICO is the main intergovernmental organisation for coffee, bringing together exporting and importing governments to tackle the challenges facing the world coffee sector through international cooperation. Its Member Governments represent 98 per cent of world coffee production and 67 per cent of world consumption.

For more information, visit www.ico.org