Luckin Coffee’s new flagship in Shenzen, China, represents a significant departure from its usual low-cost methodology, with the two-storey Origin Flagship reportedly selling more intricate and premium drinks.

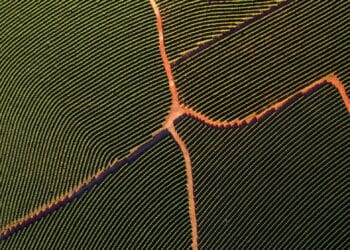

While most Luckin outlets offer prices typically in the US$1 to US$2 range, the new venue offers a range of pourover and cold brew drinks, with customers able to select beans from Brazil, Ethiopia, or grown in China’s Yunnan Province.

Luckin’s shift into the higher priced drinks space comes as rival Starbucks closes its own deal with Boyu Capital, in which 60 per cent of the world’s largest coffee company will be controlled by the Hong-Kong-based private equity firm.

Off the back of opening its first United States stores in late 2025, Luckin has now reportedly expanded to a total of 10 locations in the world’s largest consumer coffee market.

Luckin overtook Starbucks in store count in China some time ago, and the opening of its Shenzen Origin Flagship has been billed as the company’s 30,000th global location. It reported a total of 29,214 stores worldwide in its Q3 2025 financial report, released on 17 November 2025.

The Chinese coffee chain could significantly progress its international expansion in the coming months, as Centurium Capital – the private equity firm behind Luckin Coffee – reportedly exploring a bid to acquire Costa Coffee from Coca-Cola.

CEO Guo Jinyi has also explored a potential relisting of the company on the United States Nasdaq, following Luckin’s delisting in 2020.